Business Intelligence on a Limited Budget

By Wayne Eckerson

Key Strategies

The tight budgets and lean staffs of the past two years have forced BI teams to devise innovative ways to get things done. The recession has made BI teams leaner, yet more efficient. Most have by now made an art out of doing “more with less.”

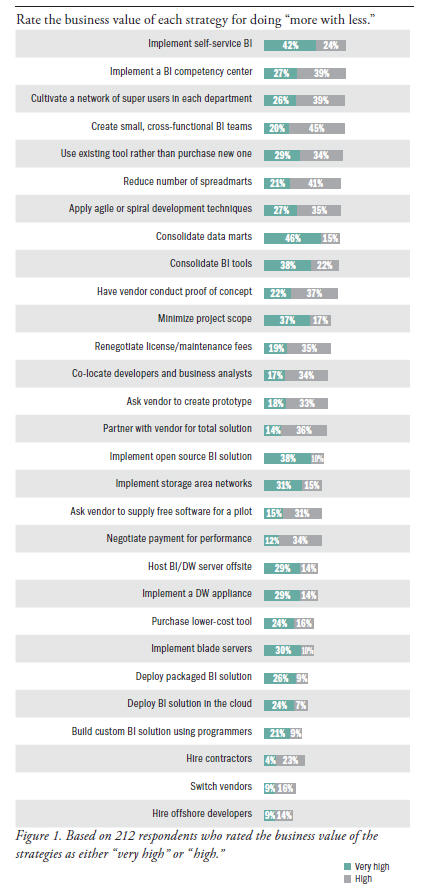

Most Popular Strategies. We asked survey respondents to rate the business value of various approaches to getting more mileage out of their BI budgets and teams (see Figure 1). More than 50% of respondents rated 14 strategies as either “very high” or “high” in business value. More than one-quarter of respondents gave the same rating to another 14 strategies. This huge list shows the lengths to which BI teams have gone in their quest to do more with less.

The top two strategies are “implement self-service BI” (66%) and “implement a BI competency center” (66%), followed closely by “cultivate a network of super users in each department” (65%) and “create small, cross-functional BI teams” (65%). Other strategies rated highly by 60% or more of respondents include: “use existing tool rather than purchase a new one” (63%), “reduce number of spreadmarts” (62%), “apply agile or spiral development techniques” (62%), “consolidate data marts” (61%), and “consolidate BI tools” (60%).

Strategies rated “very high” or “high” by at least 50% of the respondents are: “have a vendor conduct a proof of concept” (59%), “minimize project scope” (54%), “renegotiate license/maintenance fees” (54%), “co-locate developers and business analysts” (51%), and “partner with a vendor for a total solution” (50%).

Very High Value. If we examine “very high” ratings alone, we see a few strategies bubble to the top. These are strategies that respondents feel offer the biggest bang for the buck. The two most valuable strategies are “consolidate data marts” (46%) and “implement self-service BI” (42%). They were followed by “implement open source” (38%), “consolidate BI tools” (38%), and “minimize project scope” (37%). We will discuss these strategies in detail later.

There were also a few techniques that earned significant “very high” scores but few “high” scores. This suggests that the strategies proved very valuable for a small number of organizations, but were not widely implemented. For instance, this appears to be the case with “deploy BI solution in the cloud,” where more than three times as many respondents (24%) rated it as “very high” compared to “high” (7%). The same holds true to a lesser degree for “deploy packaged BI solution” (26% versus 9%, respectively), “implement a data warehousing appliance” (29% versus 14%), “implement an open source solution” (38% versus 10%), and “host BI server offsite” (29% versus 14%).

Since most of these strategies involve using newer technologies that have yet to enter the mainstream, this gap between “very high” and “high” scores is not surprising. The good news is that these new technologies—cloud, appliances, packaged solutions, and open source BI—offer significant value for companies that adopt them.

Lesser Value. There were a few strategies that got less endorsement from BI professionals than expected, such as hiring offshore developers and contractors. While nearly a quarter of respondents rated the value of these strategies as “very high” or “high,” they still were at the bottom of the high-value list.

One former BI analyst who now works at a software company told me that “offshoring has lost its luster.” Many companies are pulling development work back onshore as they discover the hidden costs of offshoring and as salaries in India and other offshore markets rise. Yet, offshoring still makes sense for many companies, especially if they have people who are experienced in managing offshore relationships and have developed processes to ensure efficient and effective communications.

Interestingly, the use of contractors and consultants earned mixed ratings. Many BI teams shed such providers during the downturn to minimize costs, but others hired more contractors for specific tasks or time-bound projects so they could avoid hiring full-time employees. “We brought on contractors for specific project phases to have more hands at minimal expense,” said one respondent.

Replacement Technology

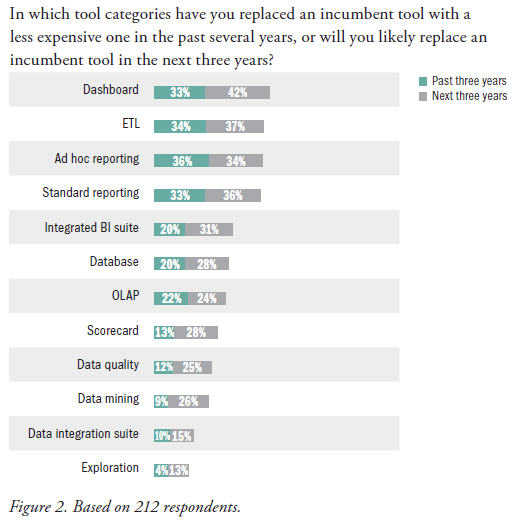

Many BI managers are replacing expensive BI tools with lower-cost ones. Figure 2 lists categories of BI tools by the degree to which organizations have replaced them with lower-cost alternatives or plan to replace them in the future. Dashboards, surprisingly, top the charts with a 75% combined score, followed by ETL tools (71%), ad hoc reporting tools (70%), and standard reporting tools (69%). These are very high rates of replacement.

Except for dashboards, each of these BI technologies is fairly mature, and many organizations want to upgrade to the latest generation of tools. With dashboards, many companies are replacing homegrown solutions with dashboard-specific products.

Future Replacements. In addition, a number of tool categories will be replaced at an accelerated rate in the next three years. For example, the replacement rate for scorecard, data quality, data mining, and exploration tools will more than double in the next three years, while replacement for integrated BI suites and data integration suites will increase by 50% or more. As with dashboards, these higher replacement rates reflect the advent of newer technologies as well as renewed interest in these BI niches. Many companies are currently using homegrown tools or none at all, or haven’t established an enterprise standard in these categories. This growth rate reflects early adoption by these types of companies.

Small and Midsize Companies

Of course, tight or nonexistent budgets and staffs are par for the course at many small and midsize companies. The recession didn’t change much in the dynamics of how they deliver BI solutions.

For instance, Gazelle.com is a 100-person start-up with 40 BI users spread across the sales, customer care, marketing, operations, and finance departments. For the combination of low cost, convenience, and scalability, the company runs its entire IT infrastructure in the public cloud, including its data warehouse—which is an open source database (MySQL)—and its BI tool.

“Our total BI cost is basically my salary plus a relatively small, monthly Amazon server rental charge and a small yearly BI subscription fee. In other words, less than six figures,” says Tom Russell, senior BI developer at Gazelle.com, which is an online electronics resale and recycling service.

Russell isn’t alone in his quest to deliver BI on a shoestring budget. More than a quarter of our respondents (26%) work at companies with less than $100 million in revenues, and another 14% have less than $500 million in revenues. At a small company, there often isn’t a formal BI program, which is the case for 22% of our respondents. About one-quarter spend less than $50,000 a year on BI maintenance, and about one-third spend less than $100,000 a year. About onequarter (26%) have fewer than two full-time equivalent staff.

Fortunately, small and midsize companies (SMBs) have many options for delivering BI without breaking the bank. Vendors offer a panoply of low-cost options, from open source tools (reporting, OLAP, databases, ETL, and predictive analytics) and cloud-based BI services to low-cost, departmental BI suites and data warehousing appliances. Despite the tough conditions of a recession, most companies can now afford to deliver BI solutions.

Wayne Eckerson is the director of Research at TDWI. He is an industry analyst and the author of Performance Dashboards: Measuring, Monitoring, and Managing Your Business (John Wiley & Sons, 2005). The new edition of his book will be available in November 2010. He can be reached at [email protected].

This article was excerpted from the full, 28-page report, BI on a Limited Budget: Strategies for Doing More with Less. You can download this and other TDWI Research free of charge at tdwi.org/research/list/tdwi-best-practices-reports.

The report was sponsored by Birst, Indicee, Jaspersoft, Kognitio, MicroStrategy, PivotLink, SAP, Tableau Software, and Teradata Corporation.

This article originally appeared in the issue of .