LESSON - How to Overcome the Limitations of Customer Data Integration

By Ravi Shankar, Senior Director of Product Marketing, Informatica

Five Key Steps to Maximizing Business Value

The pioneers of customer data integration (CDI) had one goal: improve customer-facing operations such as marketing, sales, service delivery, and billing by providing a single view of the customer. To that end, many organizations selected a CDI technology to reconcile inaccurate, incomplete, and inconsistent customer data stored in different formats in multiple systems across the enterprise. Other critical business data, such as accounts, products, contracts, channel partners, and employees, was considered unnecessary and out of scope.

Although some benefits were gained with the single customer view, many companies realized in hindsight that their CDI projects significantly constrained business value. Business problems and opportunities rarely constrain themselves to a single dimension; they are, in fact, multidimensional, and hence require a multi-domain master data management (MDM) solution.

The Limitations of CDI

Take the hypothetical example of Traditional Bank, a financial services firm providing a range of banking, investment, and trust services to individuals and small and mid-size businesses. Its CDI project successfully delivered a single customer view, helping the customer-facing teams know if they were interacting with an individual, such as John Quincy Jones, or a small business, such as Jones Consulting.

However, the great limitation of the CDI system was that it did not provide visibility into the relationships between a customer, his or her organizations (such as an employer or an affiliated company), and his or her accounts. For example, the financial advisors and service delivery personnel could not see that corporate customer John Jones, the owner of Jones Consulting, was the same as individual investments client John Jones. Therefore, they were unaware that he had a corporate checking account as well as an individual brokerage account. This resulted in two problems:

- The bank jeopardized this customer’s loyalty because the service delivery personnel were unable to accurately measure his value and delivered the wrong level of service to him.

- The bank lost revenue because its financial advisors were unable to make relevant cross-sell and up-sell offers to increase this customer’s share of wallet.

Using Multi-domain MDM to Solve Business Problems and Capitalize on Opportunities

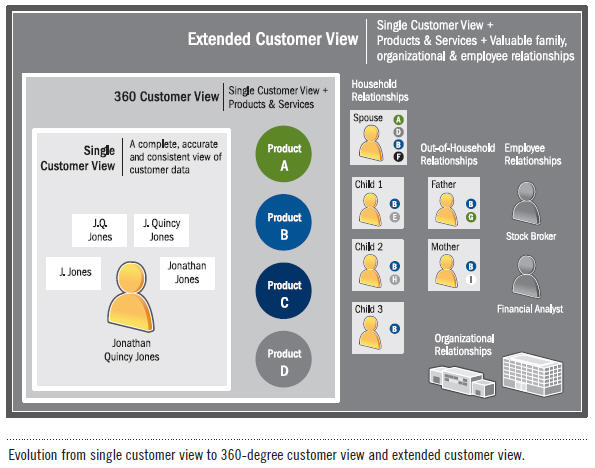

While providing a single customer view is a good first step, it creates only incremental business value. Maximizing business value requires more work. The next step is to enable the 360-degree customer view, associating the single customer view with all of his or her accounts or products across the company. The final and most lucrative step is to enable the extended customer view, revealing all of a customer’s valuable family, business, and bank employee relationships.

Take another hypothetical example of Progressive Bank, a competitor to Traditional Bank with the same business model. Progressive Bank’s team recognized that to maximize business value, its solution must extend beyond mere identification and correction of individual and corporate customers to a 360-degree view and, ultimately, the extended customer view.

The IT team was keenly aware that Progressive Bank’s business problems and opportunities were multidimensional and involved information beyond customer data. Hence, the team used a multi-domain MDM platform, which handles multiple data types.

Although its goal was the same as that of Traditional Bank—improving customer-facing operations—Progressive Bank’s multi-domain MDM solution delivered significantly more business value. Customer-facing teams gained visibility into relationships within and outside the household—they could see the relationships between a customer and his or her spouse, children, and parents, as well as all the businesses and organizations that were associated with the customer. In addition, they could view all the individual and shared products and identify which bank employees, such as financial advisors or stock brokers, worked most closely with the customer. As a result, Progressive Bank’s team maximized business value threefold:

- Improved profitability and customer retention. Service delivery personnel could accurately measure each customer’s value and align service levels to this value.

- Increased revenue. Financial advisors were able to make relevant cross-sell and up-sell offers to increase each customer’s share of wallet.

- Increased business agility and speed. The IT team could flexibly scale and adapt to changing business needs and support strategic imperatives.

The financial services example above is only one of many. Companies in other industries, such as manufacturing and high tech, consumer packaged goods, media, energy, healthcare, pharmaceuticals, and government have successfully transitioned from CDI to MDM to generate significant business value to their organizations.

One example is a pharmaceutical giant with an award-winning deployment that successfully extended its CDI initiative beyond customer data to include contracts, organizations, delivery channels, and pricing. It created a highly efficient system that utilizes relationships across different data types to:

- More accurately process payments, rebates, and disputes

- Produce reliable reports and performance metrics

- Better comply with regulations, such as Sarbanes-Oxley, which requires controls over data

- Increase customer service levels through error prevention, accurate orders, timely payments, and improved end-to-end experiences

- Adapt more quickly to changing market conditions

- Introduce new products more quickly into the sales channel

- Improve the sourcing of new customers

- Resolve potential problems faster

- Manage data and fix errors in contracting, finance, and the supply chain, using fewer resources

- Drive down the rate of write-offs, unresolved disputes, and deductions

Beginning the Journey from CDI to MDM

Multi-domain MDM can deliver on the undelivered promise of CDI by enabling the progression beyond a single customer view. These five simple steps start the journey from CDI to MDM:

- Identify the complete business problem. Unreliable data typically impacts multiple areas of the business. Fixing only customer data will not solve the business problem. Identify the components of the complete business problem.

- Include the business users. Even though IT implements a solution to solve a data problem, the business teams use the data. Include them in the discovery process to determine which types of data—and the relationships among and between data—need to be included to fully solve the problem.

- Create a single customer view. Reconcile incomplete, inconsistent, and duplicate data in different formats in multiple systems across the enterprise.

- Deliver a 360-degree customer view. Build on the single customer view by adding associated accounts across the enterprise.

- Provide an extended customer view. Extend the 360-degree customer view by adding valuable but previously untapped family, business, and bank employee relationships.

Some companies that selected a CDI-only solution could not progress beyond the third step and hence limited their business benefits. However, others made an investment in multi-domain MDM, which enabled them to progress to the lucrative fourth and fifth steps. These visionaries have overcome the limitations of their CDI initiatives and delivered significant business value to their companies with increased profits, revenues, agility, and speed. By following these visionaries’ footsteps, you will be well on your way to reaping the benefits from the larger multidomain MDM initiative as well.

For a free white paper on this topic from Informatica, click here and choose the title “Is Your Approach to Multi-domain Master Data Management Upside-Down?” For more free white papers, click here.