Customer Data Integration: The State of Customer Data Integration

An excerpt from "CustomerData Integration: Managing Information as an Organizational Asset" by TDWI Research senior manager Philip Russom reveals the results of a survey on customer data integration, or CDI.

By Philip Russom

The Perceptions and Realities of SharingCustomer Data

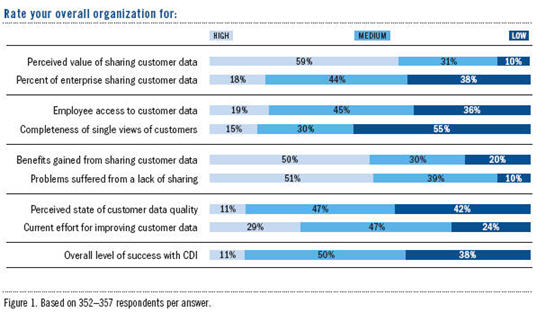

The first question in this report’s survey asked respondents to rate their organization’s perceptions and efforts as high, medium, or low for issues related to sharing customer data. (See Figure 1.) In the question, issues were grouped in pairs to reveal conflicts between perception and reality.

- Most organizations think that sharing customer data is highly valuable (59%). But sharing mostly reaches medium and low percentages of the enterprise (44% and 38%, respectively). Here, as with many CDI issues we’ll see in this report, the perception of potential benefit is way ahead of the action being taken to achieve the benefit.

- Employee access to customer data is medium to high in most organizations. Yet, the completeness of the data is mostly low (55%). The good news is that organizations are sharing customer data; the bad news is that the data being shared is sketchy.

- All respondents rated very highly both benefits and problems. In fact, few respondents rated benefits or problems as low. Clearly, shared customer data yields perceptible benefits, just as the lack of it results in noticeable problems.

- The perceived quality of customer data is mediocre, as is the effort put into improving it. This isn’t bad, given that customer data (due to its constantly changing nature) is more prone to quality problems than most data domains. This explains why the majority of data quality solutions focus on customer data, whereas other domains get little or no quality improvement.

- Half of respondents consider their organization’s CDI success mediocre (50%). Few rate their success as high (11%), and a considerable percentage (38%) rate their success as low. This shows that CDI solutions have plenty of room for improvement in most organizations.

The Scope of CDI Solutions

One of TDWI’s positions in this report is that organizations don’t share enough customer data or share it broadly enough. In a related trend, CDI is like a lot of data management practices in that it’s broadening beyond departmental silos into enterprisewide usage. Hence, the scope of individual CDI solutions—plus the aggregate effect of multiple solutions—is an important metric for gauging the breadth of customer data sharing.

In an effort to quantify the current state of CDI scope, TDWI Research asked survey respondents: “For your primary CDI solution, what is the scope of customer data sharing?” (See Figure 2.) Half of respondents (49%) claim that their organizations are already practicing CDI with enterprise scope, while another 14% report reaching the enterprise from a departmental CDI solution.

This is a surprisingly high number of organizations reaching the enterprise, given that CDI has a reputation for departmental and spreadmart solutions. Users interviewed for this research reported similar progress, corroborating the survey data. Also, many interviewees described work they had done in recent years to consolidate CDI silos into fewer solutions, extending the reach of the surviving solutions in the process. The gist of the market data is that many organizations are well down the road to enterprise-scope use of CDI techniques and practices—and that’s a big improvement for CDI.

The Number of CDI Solutions per Organization

TDWI’s impression is that the number of CDI silos and other isolated customer data solutions has decreased in recent years. After all, many corporations have run consolidation programs to reduce the number of databases and data marts—and many of these are customer data hubs. And don’t forget: customer data hubs have been around for more than 15 years, so CDI solutions deployed in the 1990s have, this decade, become legacies needing migration or retirement.

To get a feel for the number of CDI solutions per organization today, TDWI Research asked survey respondents to “enter the number of CDI solutions in your enterprise.” (See Figure 3.)

- Organizations have 5.2 CDI solutions on average. This is a manageable number, and it’s less than TDWI Research anticipated. In fact, multiple solutions are desirable in some companies, especially multinational firms with distinct customer bases that are complementary by region.

- Some organizations have no CDI solution, at all. Although CDI has been with us for decades, there is still a minority of firms (13%) that aren’t leveraging and sharing customer data officially through a CDI solution.

- The majority of organizations (60%) have one to five solutions. Again, this is good news, showing that most organizations have successfully controlled the proliferation of CDI solutions.

- A few respondents (18%) have 6 to 10 CDI solutions. If you have more than five, you might consider tightening controls on the spread of customer data.

- A minority of respondents (7%) has more than 10 CDI solutions. If you fall into this category, your situation is highly abnormal and needs immediate attention, perhaps via a consolidation project.

- Some organizations have 100 or more CDI solutions. Only 2% of survey respondents fall into this category. An extreme case like this is reached when an enterprise doesn’t control the proliferation of customer data marts, spreadmarts, and operational data stores. Hence, great numbers of CDI solutions are possible, but not common—luckily!

CDI Funding, Use, and Maintenance

It’s always telling to discover which departments fund, use, and maintain an information system, since this reveals who has the money versus who has the greatest need for the system. To sort this out, this report’s online survey instructed respondents to enter the name of the persons or departments that fund CDI, need it the most, and maintain it. There were no prewritten answers to select; instead, each of the 294 respondents typed an answer in his or her own words. The answers were quite diverse, but a handful of departments and job titles appeared much more commonly than others:

- Information technology (IT) is the most common source of CDI funding (according to 24% of survey respondents), and IT usually gets stiffed maintaining it (63%). Yet, IT rarely needs or uses CDI (3%).

- Marketing and sales occasionally fund CDI (19%), and they are certainly its most common users and grateful beneficiaries (38%). But they rarely lend a hand to maintain it (7%).

- Corporations and enterprises (12%) and chief officers of various types (10%) were listed as funding sources, though none of them use or maintain CDI.

- Business intelligence (BI) teams weren’t identified as a source of funding for CDI, although they occasionally use (3%) and maintain (6%) it.1

USER STORY: CRM consolidation is a common penance for the sins of the 1990s.

A midsize software vendor in New England went on a shopping spree in the late 1990s—as did many companies—and bought and built several CRM and CRM-ish applications for internal use. Most of these applications overlap, because they automate customer-oriented functions such as order entry, shipping, billing, direct mail, customer base analysis, and multiple approaches to sales force automation. Synchronizing customer data across these is too complex to be effective, so the firm does not have a clean or complete view of customers. Today, this firm is paying for the indulgence of the 1990s by migrating and consolidating redundant applications and their databases into a single instance of a packaged application for CRM, plus extending that instance to fill in missing functions. This is a multiyear, multistage project that employs many data management tools, as well as extensive process reengineering to ensure that end users and the business get full value from the new application.

1. According to these numbers, BI teams don’t use CDI much, which is inconsistent with other findings of this report. Other numbers show that data warehouses and customer analytics are the most common applications integrated with a CDI solution. (Back to article.)

Philip Russom is the senior manager of Research at TDWI, where he oversees many of TDWI’s research-oriented publications, services, and events. He can be reached at [email protected].

The article was excerpted from the full, 32-page report, Customer Data Integration: Managing Information as an Organizational Asset. You can download this and other TDWI Research free of charge at www.tdwi.org/research/reportseries.

The report was sponsored by Acxiom, DataFlux, HP, IBM, Informatica, Syncsort, Teradata, and Trillium Software.

Next

Previous

Back to Table of Contents

This article originally appeared in the issue of .