The Demand for Analytics Inside and Outside the Enterprise

A new survey from Jinfonet shows that the gap between the supply and demand for analytics insights for commercial customers presents a huge opportunity for companies.

- By Dean Yao

- November 10, 2016

According to a leading analyst firm, the worldwide business intelligence (BI) and analytics market is expected to reach nearly $17 billion this year. Given the market’s magnitude of growth, Jinfonet Software was curious to know how businesses are thinking about and approaching BI and analytics, both inside and outside of their enterprises.

For several decades, the majority of enterprise BI investments have focused on internal processes and users. However, when Jinfonet recently surveyed more than 400 senior IT and business professionals, we found that efforts are shifting more towards analytics for commercial products and services.

The percentage of respondents currently working on external customer projects was a fairly big surprise. The survey results provide a number of insights, but one of the most interesting is where business executives stand in terms of the need to deliver analytics to their external customers.

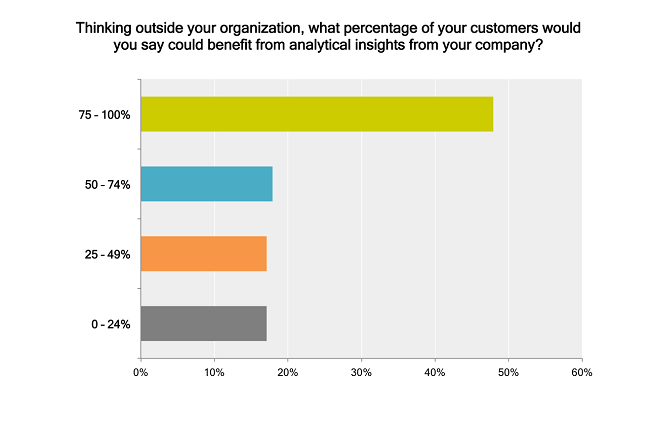

Figure 1. Percentage of

external customers that could benefit from analytical insights.

As a leading embedded analytics software vendor, we were fascinated to see that despite the needs expressed in Figure 1, only 26 percent of the survey respondents provide analytics to 75 percent or more of their customers. These results provide a clear indicator of the market's need for commercially focused analytics projects.

From a solutions perspective, many options exist, from a static report attached to email to a dedicated application. Without getting too detailed, the commercial analytics survey sought to capture insight into what business leaders think an ideal solution looks like for their customers.

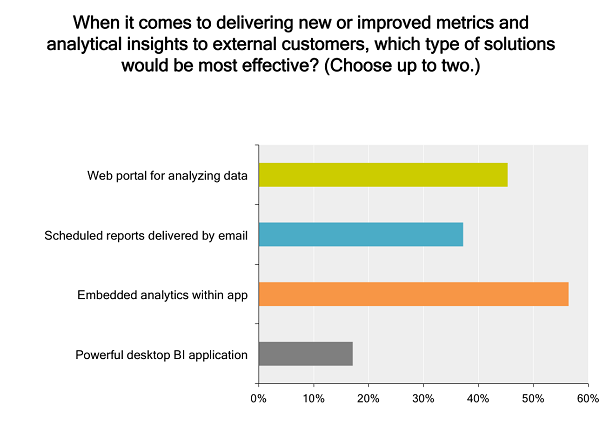

Figure 2. Most effective solutions for delivering analytical insights to

external customers.

Among respondents focused on commercial projects in Figure 2, 56 percent chose “a purpose-specific set of visualizations and analytics embedded within products, websites, or applications used by customers.” For respondents focused on BI and analytics for internal enterprise users, we asked the same question regarding an ideal solution (the results are shown in Figure 3).

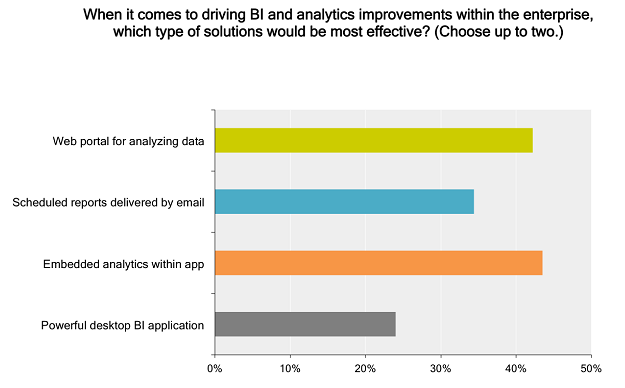

Figure 3. Most effective solutions for delivering analytical insights to

internal users.

Although report designers and power users require dedicated discovery and analysis tools, we couldn’t agree more that embedding a tailored BI or reporting solution is an effective method for enabling a large number of casual users or customers. When it comes to the ideal type of solution for internal enterprise users and external customers, the survey results demonstrate a preference for purpose-specific embedded analytics solutions.

The survey also uncovered insight into the challenges of delivering analytics for customers and internal users. The two greatest impediments to deploying BI and analytics to users were cost of deployment and choosing the right type of product.

If an enterprise had BI and analytics in a cloud or was planning to migrate components there, the main driver was to reduce IT operations cost (44 percent) followed by the desire to offer a SaaS solution (33 percent). Overall, survey respondents were split 50/50 between those who are moving analytics components to the cloud (or planning to) and those who have no plans to migrate to the cloud.

Overall, this survey found that the gap between supply and demand of analytics insights for customers presents a huge opportunity for companies. The results demonstrate that product and service owners are aware of the need to enhance offerings with data analytics and insights, but are still struggling to deliver them -- a challenge that companies can overcome through embedded analytics.

About the Author

Dean Yao has over 10 years of experience in software marketing and product management. Prior to working at Jinfonet Software, Dean was a senior product manager at cloud computing startup Nimbula (acquired by Oracle), where he focused on technical best practices, competitive marketing, and product strategy. Dean was also in technical marketing at VMware, specializing in virtualization clustering and resource management products. You can contact the author at [email protected].