Transforming Finance

By Wayne Eckerson

The New Role for Finance

At an increasing number of companies, forward-thinking finance

departments are transforming themselves from back-office providers

of accounting services to strategic advisors to the business. To

facilitate this metamorphosis, forward-thinking finance departments

have reengineered how they handle information, treating it

as a valuable corporate resource that not only paints a picture of

the past but also paves a clear path to the future.

Historical Role. Historically, the finance department has kept the

books, managed the budget, and looked after cash, capital, taxes,

treasury, and statutory reporting. But there is less tolerance in an

increasingly competitive global economy for people and processes

that don’t add direct value to an organization. As with other shared

services (e.g., information technology and human resources), there

has been a movement in the past decade to transform these finance

functions into more active contributors to the bottom (and top)

lines of the organization.

Finance, in particular, can be a powerful agent of organizational

change. That’s because it sits at the information nexus of the organization.

It collects financial and non-financial data from every

business unit on a regular basis and consolidates that information

into summary and detailed management reports. But to add real

value to the organization, finance needs to move beyond basic data

collection and reporting. It must mine the information it collects

for trends, patterns, and insights so it can advise the business how

best to improve operations, optimize performance, and adapt to

changing business conditions.

Partnering with the Business. Forward-thinking finance departments

form tight partnerships with the business. They collaborate

with business managers on a range of issues that ultimately drive

financial performance: how to optimize pricing, reduce inventory,

rationalize sales commissions, improve the profitability of merchandise

assortments, reduce call center costs without affecting service,

streamline provisioning and procurement processes, and make

build-versus-buy decisions. Finance might also help the business

evaluate whether to extend store hours, source parts from a new

supplier, merge with another company, or take on a new partner.

“We need to collaborate with the business if we are going to improve

the financials,” says a CFO from a major online retailer who asked

not to be named. “Showing them actuals and targets isn’t enough;

we need to help them reengineer fundamental processes. In short,

we need to change from being a financial record keeper to a proactive

partner with the business.”

Room to Improve. Unfortunately, the majority of finance departments

have yet to adopt this new role to a significant degree. Our

survey shows that although the finance department has made

strides toward becoming a trusted partner with the business, it still

has a long way to go.

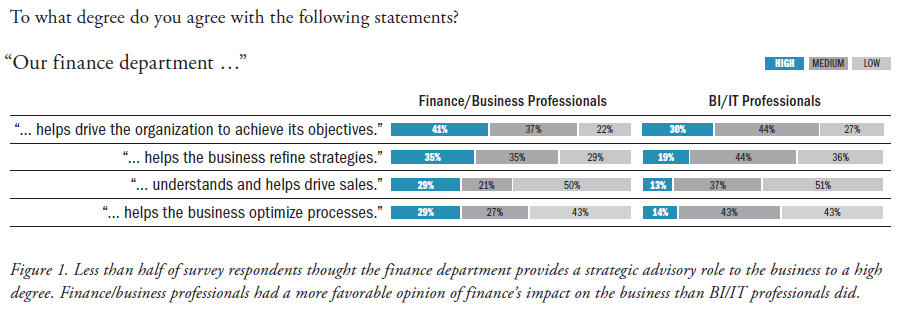

Less than half of financial professionals who responded to the survey

believe their finance departments, to a high degree, help the organization

“achieve its objectives” (41%), “refine strategies” (35%), “drive

sales” (29%), or “optimize processes” (29%). In fact, more than 20%

of finance professionals gave their finance teams a low rating in these

areas, with a larger percentage saying in effect that the finance department

does little or nothing to help the business “optimize processes”

(43%) or “understand and help drive sales” (50%). (See Figure 1.)

However, when you examine the high and medium scores in each area,

about three-quarters of finance professionals believe the finance department

helps the business in these areas to some degree. This shows that

finance understands its new role and is making progress toward fulfilling

it but is not yet executing at a high level. This is good news, since

the rallying cry about the need to transform finance has been around

for more than a decade.

Divergence from BI. Not surprisingly, finance/business respondents

had a more favorable opinion of the finance department’s impact

on the business than BI professionals did. This gap reflects a yawning

divide between finance and the BI professionals who manage

the finance department’s most precious asset: data. This report will

examine this organizational divide in detail and prescribe remedies

to close it.

Single Version of Truth

Information Infrastructure. Finance departments that proactively

advise the business have at least one thing in common: they’ve standardized

financial information throughout the organization and

harmonized it with detailed transaction data used by the business.

This provides a consistent set of information that both finance and

business unit managers can use to understand past activity, forecast

the future, and make important decisions.

This so-called “single version of truth” liberates the finance

department to focus on value-added activities that drive business

performance. “Our finance community has been a big proponent of

a single version of truth and enterprise business intelligence because

it has helped them undergo a major transformation,” says Bobby

Ghoshal, manager of enterprise business intelligence at Freescale, a

semiconductor manufacturer in Tempe, Arizona. “Our finance team

now spends 80% of their time analyzing data and providing value to

the business, and 20% collecting it, instead of the other way around.”

The Role of BI Teams. To deliver a single version of truth,

organizations rely on BI teams to collect and integrate data from

multiple financial and other systems and make it available to users via

self-service reports, dashboards, or analytical tools, including Excel.

These self-service tools liberate finance and business users from having

to request custom reports or views of data from the IT department

and allow users to get the data they want when they want it.

Ideally, the BI team consolidates the integrated, cleansed data in an

enterprise data warehouse and subject-specific data marts that contain

all the subject areas users want to explore down to transaction-level

data. In reality, the data warehousing environment rarely contains all

the data that finance and business users need, so the BI team needs to

provide BI tools that let users query various data sources directly and

combine the results in reports, dashboards, or spreadsheets.

The Upshot. With consistent, integrated data and self-service

reporting and analysis tools, a finance department can spend the

majority of its time analyzing data and advising the business instead

of collecting, compiling, and massaging data. Mirroring the scenarios

described earlier, a comprehensive BI environment allows:

- Financial analysts to spend less time producing standard

financial reports and more time analyzing the root causes

of performance anomalies and working proactively with the

business to fix or avert problems.

- Financial managers to spend less time collecting financial

and operational data and more time modeling scenarios

and forecasting results to assist with major decisions about

investments, product development, and staffing.

- Executives to avoid surprises at the end of the quarter because

they can track daily performance at every level, enabling them to

work proactively with the business to shore up areas of weakness

before the end of the next financial period.

- Business executives to understand the profitability of every

customer, product, and process on a daily basis and make major

strategic decisions with confidence using facts and not just

intuition.

- Business executives to avoid embarrassing audits or costly

penalties for failing to apply adequate controls to financial

reports and delivering accurate data to financial stakeholders.

Office Depot. Many financial departments are now beginning to

reap some, if not all, of these benefits. For example, Office Depot has

constructed an enterprise data warehouse that aligns financial and

product data at a detailed level. By merging financial and product

hierarchies and data, Office Depot now has a common language that

enables finance and merchandisers to communicate about product

profitability and figure out ways to improve it.

In the company’s copy and print center, financial analysts using

a variety of BI tools noticed that black-and-white copiers weren’t

generating as much profit as color copiers, and they worked with

the business managers to shift their inventory to color copiers. In

another instance, financial managers noticed pricing discounts were

edging higher than expected in several locations and notified business

managers who took action.

“In the past, finance had its profit/loss statement and merchandising

had its sales and gross margin reports by product, but the two weren’t

connected,” says James Hoganson, director of sales accounting and

reporting at Office Depot. “Now, both groups can see the profitability

of individual products on a daily basis, which has enabled the business

to change its strategies more quickly.”

Recommendations

Business intelligence can empower the CFO and finance department

in their quest to better serve the business. When implemented

properly, BI can provide timely insights, which the finance

department can use to help business managers make better strategic

and tactical decisions that lead to better financial results.

To empower the CFO with BI, we recommend the following:

1. Get a sponsor, find and understand the pain. Implementing

BI is an exercise in change management. To succeed, you need an

executive sponsor and a chief lieutenant to drive requisite changes and

sustain the initiative for several years until it reaps dividends. The

best candidates are sponsors who suffer from a lack of visibility into

strategic and operational performance and who are willing to certify

and use the reports the new environment will generate.

2. Partner with the BI team. The BI team is responsible for

delivering clean, consistent financial data, applying appropriate

rules and adjustments, and integrating that data with operational

data from non-financial systems. But the BI team cannot perform

this work alone. It needs to work closely with subject matter experts

in the finance department who understand financial rules and

processes and can interpret the data for the BI team. This requires a

tight partnership between the finance and BI teams in which each

respects what the other does and understands the problems each

encounters along the way. To achieve this partnership, executives

often assign finance experts to serve on the BI project team and BI

managers often recruit tech-savvy financial analysts to work full

time in their departments.

3. Homogenize the general ledger and chart of accounts. To

meet the needs of the finance department, it helps to consolidate all

general ledgers onto a single platform and harmonize the chart of

accounts throughout the organization. This is a major undertaking,

but it greatly reduces the tedious integration work that can slow

down data warehouse deployments (or that requires a boatload of

accountants if done manually). When organizational structures make

such standardization impossible, companies should use financial

consolidation tools to harmonize the financial data. In addition, the

data warehouse can serve as the single point of integration while a

company is migrating to a new global general ledger system.

4. Build an enterprise data warehouse. To deliver the single version

of truth desired by the CFO and other executives, the BI team

should design the data warehouse to be enterprise in scope, linking

operational data with financial data. This enables users to shift from

a financial view of the business to a transactional view to see what’s

driving the numbers, and vice versa. It’s important to remember than

an enterprise data warehouse is built in small steps, one logical data

mart at a time, each providing business value. This process requires

visionary sponsors willing to sustain their commitment and funding

over years.

5. Deliver self-service BI tools. Executives, managers, and other

financial staff must be able to access data directly without IT

involvement. This requires the BI team to implement self-service BI

tools that make it easy for users to drill from summary level views to

detailed data without getting lost, and to preserve views by scheduling

them as regular reports. These reports should be able to pull data

from multiple locations so users can view critical information in one

place with one tool instead of hunting around for data using multiple

software products.

6. Deliver timely, detailed data. Reports that only contain

summarized views of financial and operational data are virtually

useless to financial managers and analysts. To get to the root of a

problem or issue, financial managers and analysts need to view details

and filter data by different dimensions. They also need to see the

freshest data possible so they can identify issues, analyze options, and

work with the business to take action before the problem shows up

on the bottom line. BI teams need to architect the data warehouse to

provide timely data and/or offer robust BI tools that can federate data

from multiple locations in real time.

7. Coexist with Excel. Although financial managers and analysts

are comfortable using Excel, most do not understand its limitations

as a data management system. To enjoy the benefits of Excel without

experiencing the drawbacks, use Excel as a client to BI servers that

manage the data in a consistent way via the data warehouse. It’s also

important to prohibit the use of Excel-based reports that conflict with

CFO-certified reports generated from the data warehouse, to prevent

users from publishing their own reports to a shared server or portal

without permission.

8. Create an ad hoc environment for financial analysts. To

perform ad hoc analyses, financial analysts must combine data from

multiple systems, including the data warehouse. The analytical

environment must be flexible enough to allow them to apply

sophisticated transformations and calculations. Excel is the default

ad hoc analytical tool of choice for financial analysts. But BI teams

should consider exposing the analysts to other tools that extend

the scope and scale of their analyses. This would include predictive

analytic tools that model patterns in large volumes of data; visual

discovery tools that let users interact with data visually at the speed

of thought; and analytic sandboxes that reserve a partition of the data

warehouse for users to combine and merge data warehouse data

with their own.

9. Leverage the data warehouse to support other financial

applications. A data warehouse is more than a reporting vehicle. It is

a corporate resource of integrated data that can support a multitude

of analytic applications either directly or through a series of logical

data marts. These include planning and budgeting applications,

performance management applications such as dashboards and

scorecards, and profitability and risk management applications.

Wayne Eckerson is the director of Research at TDWI. He is an industry analyst and the author of

Performance Dashboards: Measuring, Monitoring, and Managing

Your Business (John Wiley & Sons, 2005). The new edition of his

book will be available in November 2010. He can be reached at

[email protected].

This article was excerpted from the full, 32-page report,

Transforming Finance: How CFOs Use Business Intelligence to

Turn Finance from Record Keepers to Strategic Advisors. You can

download this and other TDWI Research free of charge at

tdwi.org/research/list/tdwi-best-practices-reports.

The report was sponsored by MicroStrategy, Oracle, Teradata, and

Visual Mining.

This article originally appeared in the issue of .