Predictive Analytics in the Real World: Utilities and the Pandemic

Using predictive analytics can help utilities safeguard revenues and protect at-risk customers.

- By Alison Alvarez

- September 25, 2020

In the age of coronavirus, when millions of Americans have lost income due to business closures and can't pay their bills, utility companies are worried. They have always worried about their most vulnerable customers, but now they are also worrying about a new group of people: middle-income earners who have lost their jobs, are suddenly unable to pay their energy bills, and have begun carrying high balances.

Analysis of one mid-Atlantic gas company's most recent customer data shows that customers will owe well over $20M this year -- revenue the utility may never see.

This means that when state-issued shut-off moratoriums are lifted, more customers than ever before could be sent to collections and potentially have their power or water disconnected. Shut-offs are obviously bad for customers; research shows that energy insecurity and power outages lead to poor mental and physical health outcomes, sending people deeper into risk.

Shut-offs are bad for utilities, too. They are expensive, laborious, and unpleasant. If company budgets fall short, utilities may not be equipped to deliver the same robust level of service to the hundreds of thousands of customers who depend on them. According to some experts, lost revenues could cause utility workers to lose their jobs and energy rates around the country to spike.

Luckily, utilities have a way out of this potential bill-payment catastrophe: predictive analytics, which is being deployed to protect utility revenues and build safeguards around vulnerable customers.

Predictive Analytics and Bill Payment Behavior

BlastPoint -- the company I founded -- uses household-level historical payment data to establish a benchmark that compares past customer payment data to current customer payment behavior. This enables us to distinguish customers at the household level who have suddenly bumped up against a wall of financial hardship from those who have been falling off a financial cliff for some time.

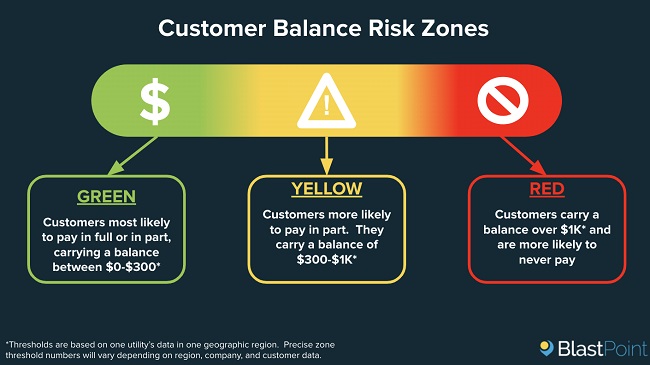

We use AI, machine learning, and data algorithms to help us quantify territory-specific dollar thresholds which reveal those customers most likely to continue paying in full and on time each month; those who will be able to pay in part but carry a balance from one month to the next, and those who are unlikely to be able to recover from a growing stack of overdue bills and late charges.

We call these specified amount-due thresholds customer balance risk zones. Depending on a utility's unique zone limits, Green indicates a customer is financially safe, i.e., in a position to pay current balances even if they are a little behind. Yellow signals that a customer has entered a period of financial hardship and needs attention now. Red denotes that a customer is in financial danger.

Image (c) BlastPoint, Inc. 2020. Used with permission.

With Customer Balance Risk Zones, utilities have clear indicators that can help them bring as many customers as possible to safety. However, getting there requires a new way of thinking.

Applying Data Analysis to Today's Problems

Descriptive sorting, or customer segmentation, has been used by businesses of all types since the early days of the 20th century. Typically, segmentation uses company data to place customers into different buckets, and companies can handle those buckets differently depending on the situation.

Building a predictive component into a customer segmentation model, as data scientists are now doing, takes the analysis to the next level. Utilities today, for example, can use AI and machine learning to determine the best methods for reaching customers.

Predictive analytics is a boon to advertising, marketing, and sales teams by helping them understand which customers are most likely to respond to postcards, billboards, Facebook ads, or email marketing. This knowledge enables targeted outreach that is more cost-effective than utilities' traditional spray-and-pray approach.

Predictive AI can also suggest the type of messaging a customer is most likely to respond to. One East Coast utility, for example, needed to determine which customers to target to boost enrollment in its paperless billing program. Through predictive analysis, they were able to differentiate customers who had an environmental affinity from those with budget-conscious values.

With these insights, the marketing team knew how to fine-tune their messaging for each customer and even diversify the delivery channels for those messages, saving nearly 2 million dollars.

Predictive Analytics During COVID-19

Companies are leveraging predictive insights to mitigate COVID-related bill-payment problems by enrolling as many newly vulnerable customers as they can into programs like government-sponsored energy assistance (i.e., LIHEAP) and hardship grants through nonprofit organizations. Participation in these kinds of programs ensures that customers retain their power while the utilities receive guaranteed payment for their services.

Utilities are also taking what they learn from predictive data analysis to actively help vulnerable customers enroll in cost-saving company programs, including budget billing, average monthly payments, or payment plans, all of which offer consistency and reliability.

Moreover, utilities are preemptively re-enrolling and re-certifying customers who already participate in assistance programs to ensure that low-wealth customers stay connected without interruption throughout the coronavirus crisis.

What we know about at-risk customers and their typical payment behavior, from reviewing years' worth of data, is that oftentimes people will wait until the last possible moment to enroll in assistance programs; i.e., when the 72-hour shut-off notice has already been hung on their front door. Although some assistance programs don't allow customers to apply until they've received their first late notice, the time to act on it is immediately. If they wait to apply until moratoriums are lifted, it could be too late: funding will already be disbursed for the year and they will have missed their chance for coverage.

Data trends also show that new late-paying customers who have never encountered COVID-19-level financial hardship before have little knowledge of energy assistance programs. They likely have no idea that they are even eligible to apply or that they could receive major discounts if accepted.

Proactive outreach is key. Utilities know that education is a crucial step in mitigating this problem, so they are working hard to spread the news and get people covered.

This situation is potentially dire, but household-level predictive insights can make a big difference in protecting utility companies' revenues and delivering quality care to all of their customers. Thanks to predictive technology tools, utilities are poised to be better prepared, more efficient, more cost-effective, and more nimble in the future.

About the Author

Alison Alvarez is the CEO and co-founder of BlastPoint. Throughout her career, Alvarez has built data tools for utility, retail and big enterprise organizations, guiding them on how to leverage geospatial and customer analytics to save millions of dollars. She served as an advisor to Valor Water Analytics, which develops customized financial data and dashboard tools for water utilities and businesses. You can reach her via email, Twitter, or LinkedIn.