Big Data Still Big Unknown According to New Survey

A new survey looks at big data readiness, investment plans, and deployment approaches.

By David White, Senior Research Analyst, ARC Advisory Group

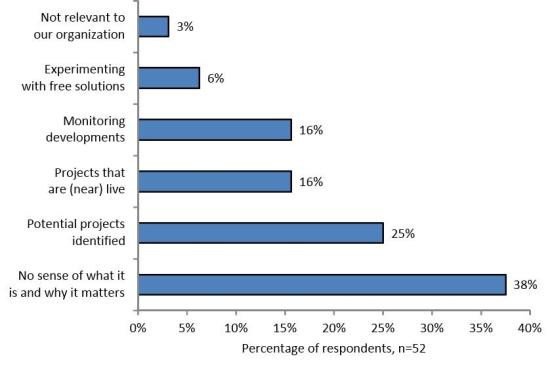

Everybody's talking about big data, but what exactly is it? If you're not really sure, you're not alone. The ARC Advisory Group, in conjunction with TDWI, recently conducted a survey among industrial corporations to understand the adoption trends for BI, analytics, and big data. Fifty-two organizations took part in the survey, yet 38 percent have no clear sense of what big data is or why it matters to their company (see Figure 1).

Figure 1: Industrial enterprise state of readiness for big data .

(For the record, the survey did not define big data, allowing survey respondents to interpret the question conceptually rather than technically.) More encouraging is that 16 percent of survey respondents currently have projects that are either live or almost live. A further 6 percent are experimenting with "free" solutions -- software that has no license fee. (Such projects are rarely free when the time required for experimentation is factored in.)

Clearly, two out of five survey respondents remain unmoved by big data marketers, and that's OK -- for now. So much current big data marketing (about features, functions, architectures, and jargon) is oriented towards a small group within IT. When real-world use cases with quantified return on investment appear more frequently, then line-of-business managers and a wider IT audience will be engaged.

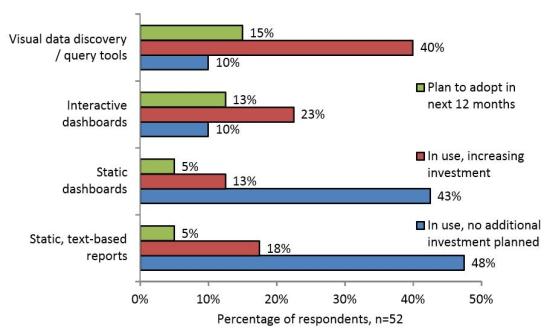

Beyond big data, industrial companies are starting to change the focus of their investments (Figure 2). Historically, many companies have relied on static reports and static dashboards to help inform decisions. (Spreadsheet use is predictably widespread, too). However, that has only helped up to a point. Survey respondents report being able to find the information they need, when they need it, only 61 percent of the time. That's one reason why enterprises are starting to invest heavily in more interactive solutions, particularly visual data discovery tools.

Static views of information work just fine as long as there are no unexpected questions. Unfortunately, unexpected questions do arise, typically because of some business event that must be resolved quickly. Almost by definition, there is no time for business or operational managers to get someone with IT skills to help pull together the additional information required to help resolve the issue. Answering unexpected questions requires business users to find the answers they need directly -- and that requires visual data discovery tools.

Figure 2: Investments are gravitating towards visual data discovery.

As Figure 2 shows, this is a major area of investment currently. Half of all survey respondents have already deployed visual data discovery/query tools -- and 80 percent of those companies are planning to invest further. Visual data discovery provides an interactive style of information access to help users quickly answer unexpected questions. Rich data and easy navigation also help managers understand cause-and-effect relationships -- true insights that can have a profound business impact. Clearly, the momentum is to move from static representations of information to more interactive forms that can help business and operational managers respond faster to situations as they emerge.

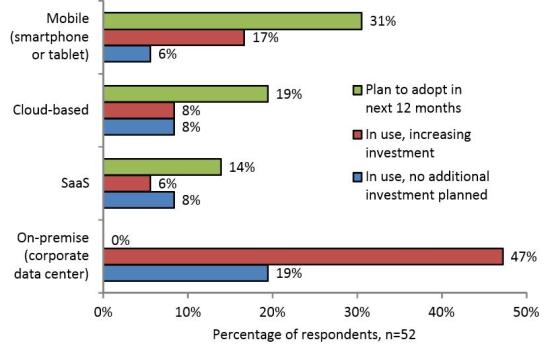

Access to data via mobile devices also helps to cut corporate reaction times. Many operational managers spend much of their time away from their desks. For example, they often spend many hours in meetings - or in industrial settings, chasing down problems on the shop floor. Consequently, pushing reports, charts, or dashboards to PCs may have little value. Pushing that same information -- combined with alerts -- to mobile devices instead can be a powerful alternative. For this reason, the use of mobile BI and analytics shows strong growth potential, too (Figure 3). Although only 23 percent of survey respondents have adopted mobile BI already; a further 31 percent plan to do so in the next year.

Software-as-a-service (SaaS) and cloud-based options for rolling out analytics are also growing in popularity. Both of these deployment approaches can help to cut the time to deliver solutions and so expand the total user population for business intelligence. Using a cloud-based infrastructure for a new data warehouse can eliminate much of the preparation work required.

For example, procuring, installing, and commissioning the hardware and software components is no longer necessary -- that work has already been done by the service provider. Likewise, a SaaS implementation provides similar benefits, but can also accelerate the implementation cycle further too by providing pre-build reports and dashboards out-of-the-box. Both of these approaches effectively outsource a significant part of the implementation work to the service provider -- plus have a much more attractive cost profile for many organizations.

Figure 3: Deployment approaches are changing.

Fortunately, this approach brings benefits for both corporate IT and business units. For IT, outsourcing much of the heavy lifting can help ensure that scarce IT skills are preserved for more strategic work, not squandered on relatively low-skilled work. Further, deploying new projects faster helps to provide BI and analytics to a larger user population. Users, on the other hand, may have been starved of any kind of business intelligence. For their part, business managers can quickly adopt a modern, powerful solution that is rich in features and nurtures a self-service approach to analytics.

[Editor's note: A copy of the full survey is available to ARC Advisory Group's clients here.] TDWI readers who participated in the survey were also mailed a full copy of the report.

David White is a senior research analyst for analytics and business intelligence at ARC Advisory Group where research has two goals: to help technology buyers get the most value from their investments in BI and analytics and to help suppliers shape their analytics product and marketing strategies. You can reach him at [email protected].